Google Flights offers: get the best prices on the tool

Offers on Google Flights can become even more attractive with the right tips. See how to help reduce ticket prices!

Travel agency

Compare prices and find the cheapest airline flight

Google Flights benefits travelers day after day by offering the best prices and real-time alerts with updated prices.

Continue lendoTickets

How to buy a cheap ticket at the last minute: best tips and tools

Find out here how to buy a cheap ticket at the last minute and save even if you have an unplanned trip!

Continue lendoTravel agency

Explore wonderful places from R$159.90, paid in up to 12 interest-free installments

Looking for affordable flights? GOL tickets are known for their competitive prices and the airline is known for its excellent service!

Continue lendoTravel with Azul: select flights within your budget and pay in up to 10 installments

See how traveling with Azul can be the way to save on your budget and still have a great flight experience!

Trending Topics

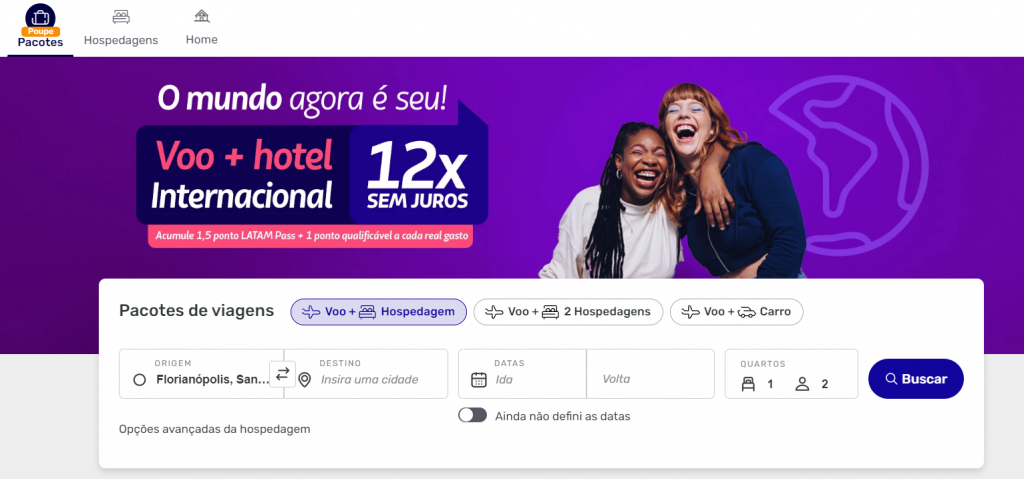

Promotions: Discounted ticket + stay!

Take advantage of LATAM Linhas Aéreas promotions and enjoy quality and excellent service on your trips.

Continue lendo

Latam's anniversary: is it possible to get tickets on offer?

Latam's anniversary could be the opportunity you're looking for to secure the destination of your dreams at low prices!

Continue lendo

Gol's anniversary: see how to buy promotional tickets

Do you want to travel for little money? On Gol's anniversary, the airline offers national and international destinations at low prices, check it out!

Continue lendoTrending Authors

Azul's anniversary: how promotional tickets work

Who doesn't want to save on travel? Azul's birthday offers are a way to guarantee tickets at low prices, here's how!

Is Agoda trustworthy? Discover the platform!

Is Agoda trustworthy? Discover the platform! Come with us to take a look at how the platform works, and much more.

How do I make reservations on Agoda?

How to make reservations on Agoda? This is the question that many have, and today we will answer it. Keep reading for more.

Continue lendoCanceled flight: what to do in this situation?

Canceled flight: what to do in this situation? Nobody knows what to do when a flight is cancelled, so find out here.

Continue lendoKLM Royal Dutch Airlines – Check out the offers from the famous airline!

Explore the best offers and services from KLM Royal Dutch Airlines. Discover incredible destinations and book your next trip.

Continue lendoKLM flight: What is it like to fly with the oldest airline in the world?

Explore affordable rates, excellent services and a global network of destinations. Discover now the advantages of taking a KLM flight!

Continue lendoNorwegian Air: trips from €38.40

Discover why Norwegian Air is the ideal choice for budget travelers looking for quality and comfort. Explore affordable rates!

Continue lendoWhat's it like to fly on Norwegian Air?

Discover more information about Norwegian Air by accessing our complete content to travel a lot while spending less.

Continue lendo