cards

C6 Carbon Black Card: a premium experience!

With the C6 Carbon card you will have access to unique advantages and benefits that only Mastercard Black cards can offer. Keep reading and understand!

Advertisement

C6 Carbon credit card: Earn points on your purchases and much more!

First of all, if you are looking for personalized service in addition to exclusive services, then you need to know about the C6 Bank Black card.

How to apply for the C6 Carbon credit card?

Check out how to apply for the C6 Carbon card and start enjoying all the benefits of a Mastercard Black card. See how to order yours!

In fact, Black cards are part of the Premium category of cards, offering advantages and benefits that no other card has. So, want to know if the C6 Carbon card is worth it? Just continue reading!

| Annuity | 12x of R$ 98. You may be exempt if you meet one of the following criteria: – Spend at least R$8 thousand per month; – Have from R$50 thousand in CDBs; – Have investments from R$1 million. |

| Do you accept negative? | No; |

| Flag | MasterCard; |

| Roof | International; |

| Benefits | Atoms points program; Access to VIP lounges at airports; Concierge; Mastercard Surprise Program; Travel insurance; No spending limit. |

How does the C6 Carbon card work?

Firstly, C6 Bank is a digital bank approved by the Central Bank that offers all its services through its online platform.

But don't worry, this is a reliable financial institution that offers practical and fast service. Among the services that fintech offers is the C6 Carbon card, in the Black modality.

Mastercard's Black cards are products aimed at high-income customers and, therefore, offer exclusive benefits that make them unique on the market.

In this sense, the C6 Carbon card is especially worth it if you travel frequently, as it can make some stages of the trip easier.

However, this credit card is only available to those with a minimum monthly income above R$5,000.00.

It is worth remembering that it charges an annual fee of R$98 per month and offers international coverage.

As it is a Premium card, the C6 Carbon card is worth it especially for those who like comfort and practicality or for those who travel a lot.

In fact, it offers several benefits that make it a very advantageous financial product.

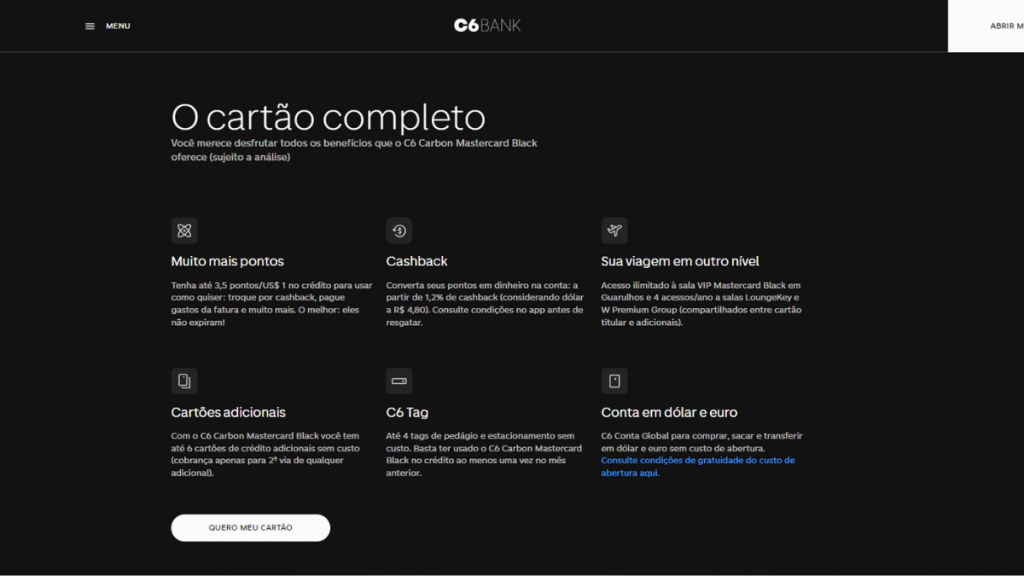

Firstly, with the C6 Carbon, you will have access to VIP lounges at airports, as well as 24-hour Concierge, Travel Insurance and Car Insurance for car rentals.

Additionally, the card offers Baggage Protection, Purchase Protection and Price Protection.

Respectively, they consist of refunds in case of loss, protection of orders against damage and theft, and refunds if you find better prices after your purchase.

Furthermore, another advantage that draws attention is that you participate in two points programs, the brand's own Mastercard Surpreenda, and the fintech's Átomos program.

Points acquired through Átomos do not expire, do not require registration, and you accumulate up to 3.5 points for every dollar spent! This is one of the best scores on the market.

Although it is a differentiated product, the C6 Carbon card is worth it to some extent. This is because access to it is very limited, as you need to have a high monthly income to apply for this card.

In addition, the C6 Carbon also charges an annual fee, and the amount ends up being a little high, totaling R$1,104.00 annually.

Although you may have a fee waiver or discount, you need to spend more than R$4,000.00 monthly to get this benefit.

If you are interested in having this exclusive card and meet the prerequisites, simply access your C6 application and request the product.

In fact, it is worth remembering that it is only available to C6 Bank account holders.

So, do you think the C6 Carbon card is worth it and want to see in detail how to order yours? All you have to do is access our content below, where we will show you the step-by-step process and the request options for you to order your Black card from the C6 bank, the Carbon card! Check out!

How to apply for the C6 Carbon credit card?

Check out how to apply for the C6 Carbon card and start enjoying all the benefits of a Mastercard Black card. See how to order yours!

About the author / Samantha Scorbaioli

Trending Topics

Best online travel agencies: see 8!

Get to know the best online travel agencies, discover their advantages and choose which one will be part of your next trip. Know more!

Continue lendo

How to easily buy at Top Travel?

See how to buy with Top Travel to get accommodation, tickets, car rental and more quality services!

Continue lendo

Eurotrip: which countries to visit in Europe?

Are you going to travel around Europe but don't know where to start? Check out some tips to improve your Eurotrip! Know more.

Continue lendoYou may also like

Early morning flight promotion: save up to 70%

Want to travel cheap and save on airline tickets? So see how to find flight deals at dawn and travel more for less!

Continue lendo

Is Forfun Tours Travel reliable? See how it works before you buy

If you want to take a trip to Disney, check if the agency Forfun Tours Viagens is reliable and start planning your dream trip!

Continue lendo

Check out the top 9 tips for shy solo travellers!

Check out essential tips for shy tourists who want to go solo. Learn how to make the most of it and make new friends!

Continue lendo