cards

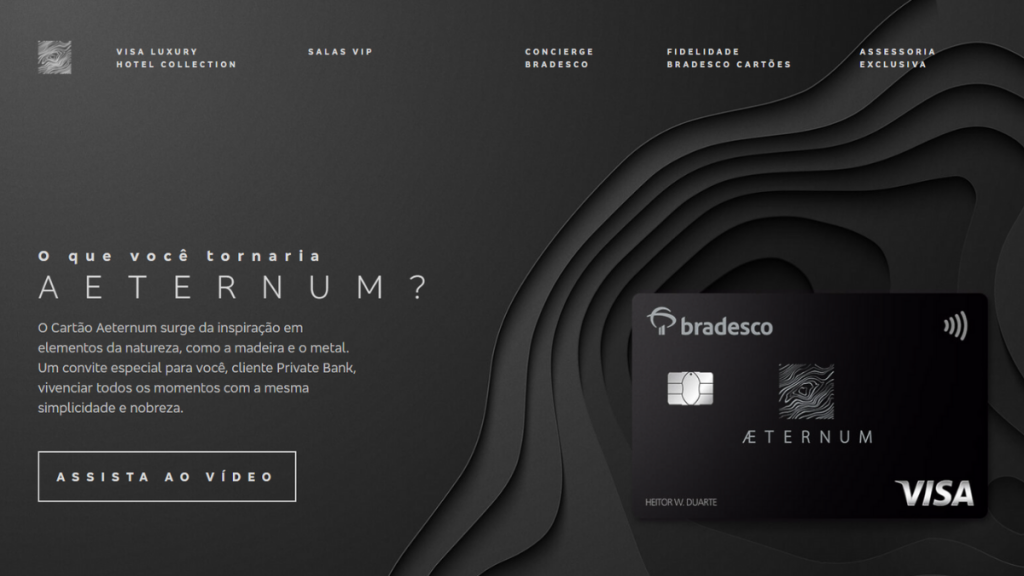

Bradesco Aeternum Visa Infinite Card: Luxury and Convenience

With the Bradesco Aeternum Visa Infinite card, customers access VIP lounges at airports together with a companion. The card has a long list of benefits for you!

Advertisement

Bradesco's best credit card: Bradesco Aeternum Visa Infinite Card!

A financial product made for customers with high purchasing power, the Bradesco Aeternum Visa Infinite card is worth it for those who want differentiated service.

How do I apply for the Bradesco Aeternum Visa Infinite Card?

See the step-by-step instructions to apply for the Bradesco Aeternum Visa Infinite card and enjoy its benefits!

In this sense, this card has an extensive list of advantages that make its customers' lives more comfortable and practical. Check out everything you need to know about him below!

| Annuity | R$1,680.00; |

| Do you accept negative? | No; |

| Flag | Visa; |

| Roof | International; |

| Benefits | Discounts at hotels and resorts; Access to VIP lounges at airports; Bradesco Concierge Service; Non-expiring points program; Insurance and much more. |

How does the Bradesco Aeternum Visa Infinite card work?

Bradesco bank emerged in 1943 and remains in the financial market as one of the largest banks in Brazil.

Among the various financial products it offers is the Aeternum Visa Infinite card, the institution's best card.

But, is the Bradesco Aeternum Visa Infinite card worth it? Well, the benefits of this credit card are aimed at those who travel frequently, such as Travel Insurance and access to the VIP lounge at airports.

Furthermore, it is available to Bradesco's high-income customers, Prime and Private customers, in addition to charging an annual fee of R$1,680.00. In other words, it may not be a card that is easily accessible to everyone.

That's even if you're a Bradesco customer. So it's worth talking to your account manager to check availability.

And, to convince yourself, check out the main advantages and disadvantages of the card below.

Benefits

Firstly, the Bradesco Aeternum Visa Infinite card is worth it for the incredible discounts it offers at Visa partner hotels. Furthermore, it guarantees greater comfort when traveling with access to airport VIP lounges.

Furthermore, this credit card also offers various insurance policies such as Travel Insurance, Luggage Insurance and even Ticket Insurance, in case of flight cancellations or delays.

In other words, its advantages are mainly aimed at those who travel frequently. And, if you need personalized service with restaurant tips, flight reservations and other services, you can have that too.

This is because customers have a Visa Concierge available. In fact, the customer can access their account at any time of the day, from anywhere in the world! Finally, this credit card's points program is also advantageous.

In this sense, it offers 4 Livelo points for every dollar spent abroad or in Brazil! And best of all, the points don't expire and you can exchange them for products or airline miles! Incredible, isn't it?

Although it is quite advantageous, the Aeternum card also has its negative points. So, keep an eye out and analyze carefully to make sure the Bradesco Aeternum Visa Infinite card is worth it for your financial profile.

Generally speaking, this card is difficult to access and is only available to a select group of Bradesco customers. In addition, he charges an annual fee of a high amount, R$1,680.00.

And, in fact, there are other Infinite card options on the market with lower fees that may be more worth it.

In fact, we recommend that you consult them before making a decision, right?

So, do you think the Bradesco Aeternum Visa Infinite card is worth it and want to get yours? Be aware that you need to become a Private or Prime customer to have access.

In fact, do you want to see a detailed step-by-step guide on how to order yours? Just access our exclusive content below to answer all your questions about this!

How do I apply for the Bradesco Aeternum Visa Infinite Card?

See the step-by-step instructions to apply for the Bradesco Aeternum Visa Infinite card and enjoy its benefits!

About the author / Samantha Scorbaioli

Trending Topics

Where to travel with 3 thousand reais: 5 unmissable tips!

Are you wanting to enjoy and take a trip, but don't know how to travel with 3 thousand reais? Check out some destination options!

Continue lendo

Are international travel packages worth it?

Everyone has doubts if international travel packages are worth it! But they can bring you savings and facilities. Learn more here!

Continue lendo

TripAdvisor: find out how it works and if it's reliable!

If you are planning a trip, find out if TripAdvisor is reliable and get to know the services offered by the company! Know more!

Continue lendoYou may also like

How to buy easily at NTour Viagens?

Check out how to buy through NTour Viagem and enjoy the exclusive itineraries that the agency offers for the female audience!

Continue lendo

Embarca.ai app: see how it works and if it's worth it!

Find out if the Embarca.ai app is worth it for your bus trip. Search and compare tickets from different companies in one place!

Continue lendo

Are package tours more convenient? See tips to enjoy!

Travel packages are more convenient and work as bundles of services that can make your trip much easier. Check out!

Continue lendo